On a Personal Note

Happy New Year, y’all! I hope all of you had a good start to 2024.

As you can see, I have moved my newsletter from TinyLetter to Substack. The reason for this is rather straightforward: MailChimp is shutting down TinyLetter and thus I am starting 2024 with a clean slate on a new platform. I was even able to import my whole archive, so s/o to Substack for maintaining 4+ years of work and for making the transition so smooth <3

To start the year with a blast, I have some special editions coming your way this week. Today, we will be starting by looking at financial markets and my annual portfolio update before moving towards my less material goals later this week and then topping everything off with the annual review of last year’s predictions as well as my bold predictions for 2024.

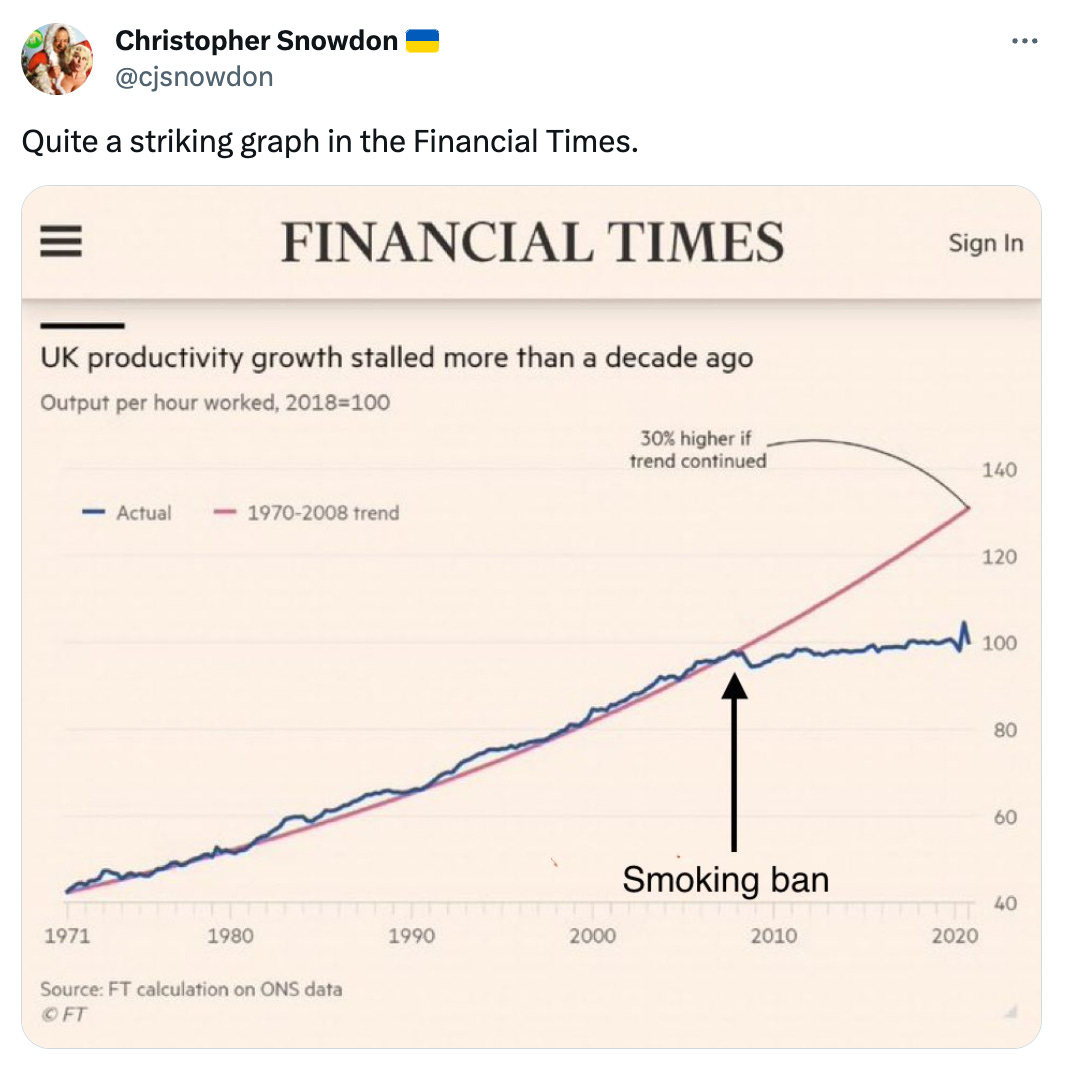

Meanwhile a PSA to those of you who put “Quit Smoking!” on their New Year’s resolutions. For the sake of civilization, you might want to rethink that decision and just replace that cigarette with some decent (i.e. more nicotine-filled) Snus. (Obviously, this ain’t health advice!)

Portfolio Q1.2024

Welcome to my annual portfolio update. In case you have missed the previous ones, this post from last year might be a good place to start as I was explaining my overall strategy there in greater detail.

As this is just an update on last year’s performance, I will not spend much time talking about my general approach. The tl;dr is that I actively manage a portfolio of 100+ assets that consists of two rather opposing components as its base: (1) high-growth tech & crypto; and (2) dividend stocks to maintain a monthly cash flow. I then combine this idiosyncratic approach with regular sector rotations/gambles (e.g. in recent years an anti-ESG strategy, incl. defense stocks and tobacco companies).

Disclaimer: This is not financial advice! My risk appetite is not in any way recommended for anyone else—and you should not follow investment tips from a random dude on the internet. I have been trading financial assets since I was 14 when my dad first built a portfolio for me and had longer periods with no exposure to financial products at all.

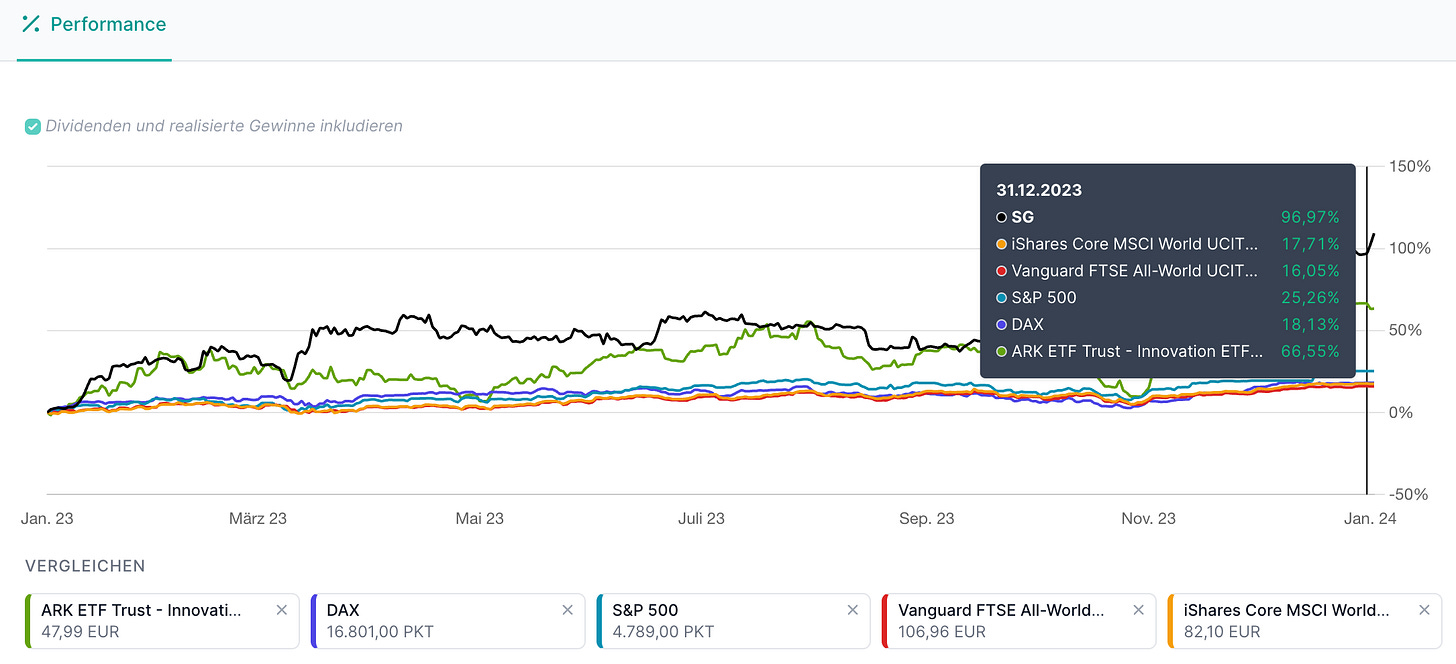

Let’s start by looking at 2023:

Portfolio Performance: 96,97%

To compare my performance, I picked the American S&P500, the German DAX, Core MSCI World (i.e. developed market index), FTSE All-World (incl. emerging markets), as well as Cathie Wood’s flagship ARK Innovation ETF as relevant benchmarks. I thought the ARK might be more relevant than a generic Nasdaq100 ETF.

And as you can see, I significantly outperformed each index. However, this is also due to the fact that many of my assets significantly rebounded after a terrible 2022—where I underperformed most relevant benchmarks. Before I will go into more detail, I will put those results in a more long-term perspective.

So, here is the 5-year performance:

As somebody with active portfolio management, the criterion is that this strategy must yield more performance than a mere passive investment strategy—at least in the medium term. Otherwise, I could just put my money in an MSCI ACWI ETF and don’t bother. Luckily (as of now), I still continue to outperform all relevant benchmarks over the five-year horizon. Of course, you might wonder whether this particular timeline is just cherry-picking. However, I am here just using the maximum data available. For technical reasons, I couldn’t include any activity before 2017—which would have included very favorable trades of Apple, Amazon, and Volkswagen (amongst others). As I put everything online now, we will be able to track this even better in the future.

Now, let’s dive right into the more concrete data.

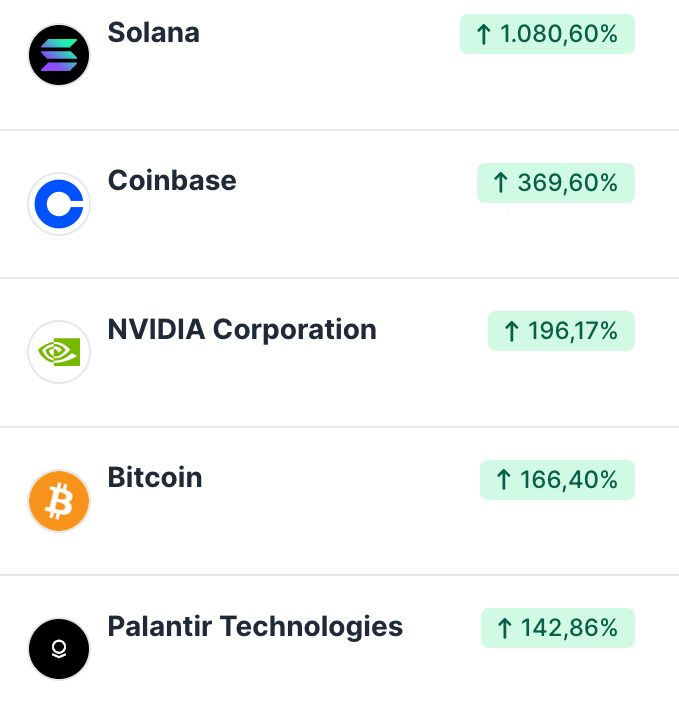

Top Performers 2023

No surprises here, the crypto rebound and AI hype jointly drive the main performance. Yet, since $SOL and $BTC are kind of screwing the picture here, I thought I might also include another performer list ex-crypto. This will also provide you a better insight into my current portfolio.

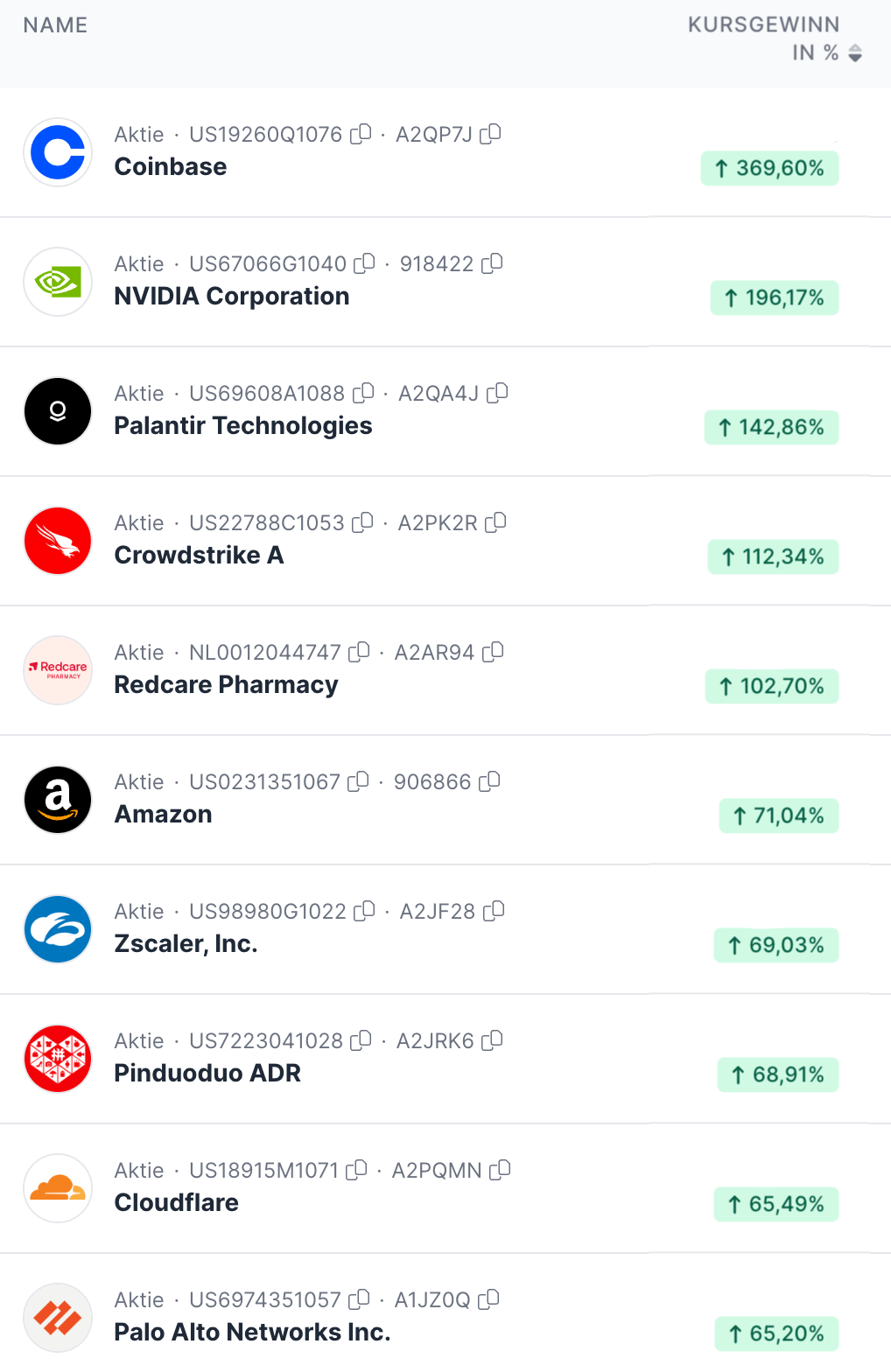

Top Performers 2023 (ex-crypto)

You might wonder why some of the stock performances differ from their general YTD results. The reason for this is rather easy: I purchase most assets on a dollar-cost averaging strategy, i.e. I have created savings plans for most of my stocks and crypto so that I don’t need to time the market for the best rate. And as the overall money that I invest changes each month, you will get these peculiar results. BTW, PDD 0.00%↑ (due to the success of Temu) is the only stock that shows up for a second year in a row in the Top Performer list.

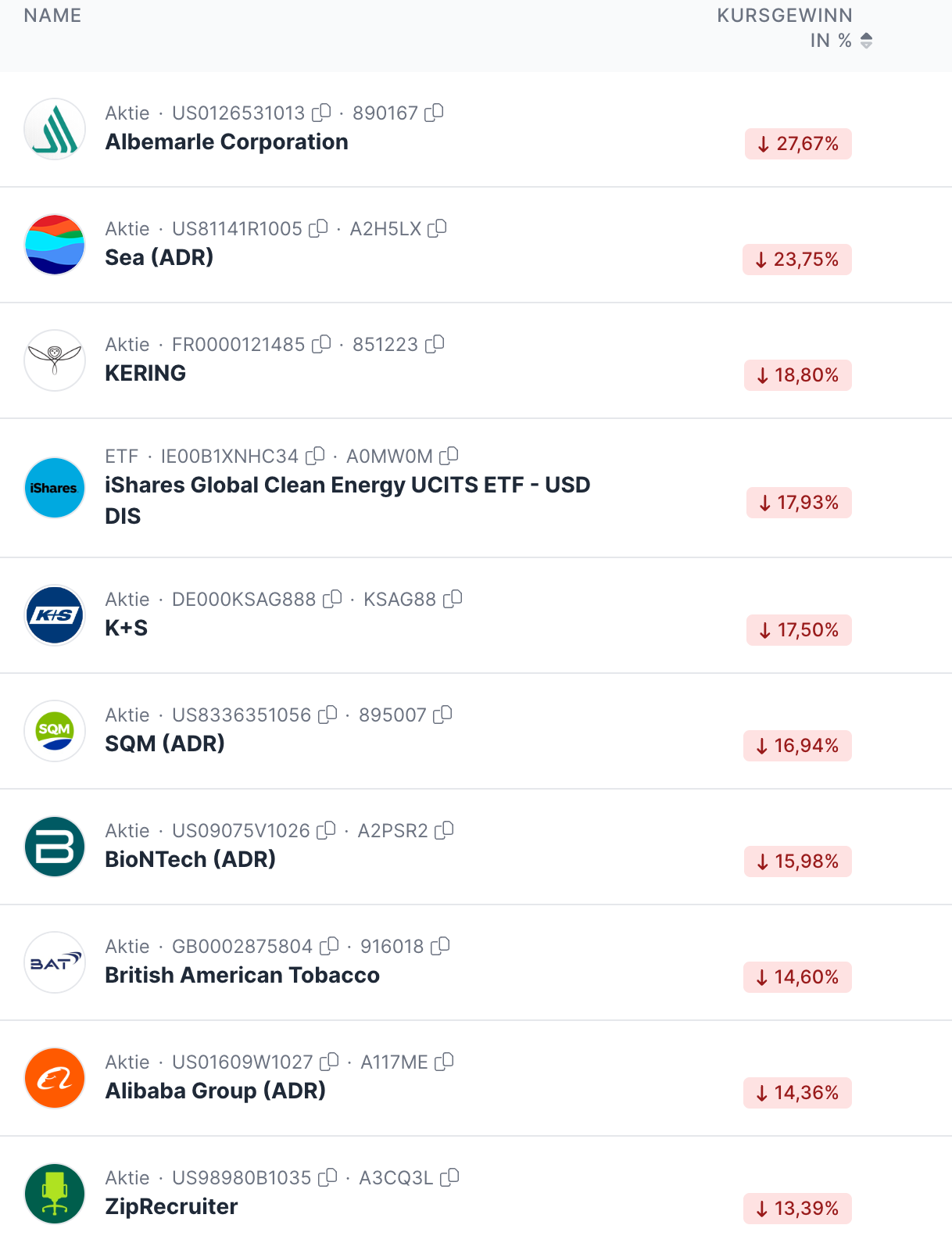

Worst Performers 2023

E-Commerce, Green Energy, and Commodities are still struggling. But besides BABA 0.00%↑ and SE 0.00%↑, these are all very small position sizes that have been underperforming this year. Again, compare that to $BTC, COIN 0.00%↑ , or AMZN 0.00%↑ from the Top Performers which have traditionally been the largest parts of my portfolio.

Concluding Remarks

As we will see in my predictions newsletter, I have been directionally right when it came to macro questions. And this basically explains most of my outperformance—as rate cuts favor strong allocations towards risk assets, such as non-profitable tech and/or crypto. Of course, the FED hasn’t cut rates yet; but the market already prices in several rate cuts, starting from Q1.2024. That’s what matters. To sum this up, there were no specific individual trades that would make me look like a financial genius; rather, the general market environment favored my approach and positioning in the market.

Nevertheless, I think there are 1-2 more specific things that are worth mentioning. Because they will further explain my outperformance at the margin.

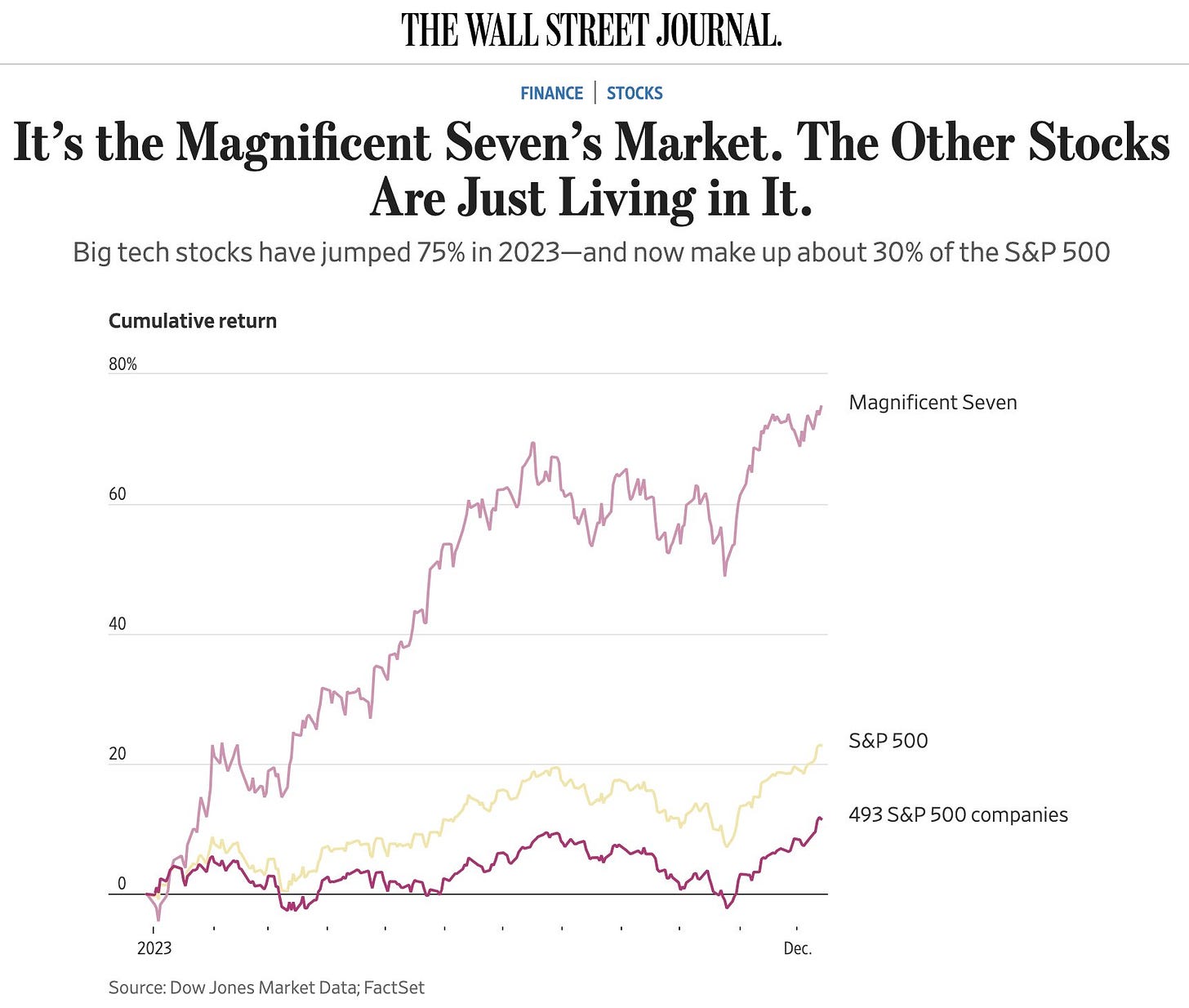

First, one needs to understand the power of the so-called “Magnificient Seven”: AAPL 0.00%↑ , AMZN 0.00%↑, GOOGL 0.00%↑, META 0.00%↑, MSFT 0.00%↑ , NVDA 0.00%↑, TSLA 0.00%↑. Because these seven stocks basically drove all market performance in 2023—and are the reason your MSCI World is doing so well.

As mentioned in my previous updates, I have been long Big Tech myself—where (at times), NVDA 0.00%↑ and AMZN 0.00%↑ became my largest individual positions through different stages of the year. However, I have always been selective about the M7 basket that I hold. For example, I traded out of TSLA 0.00%↑ in 2021 and never touched META 0.00%↑ (besides some shorts in 2022). While I don’t think that Big Tech will (as a whole) underperform next year, I started to rotate some money into Small Cap ETFs. That will probably be one of my sector gambles for the upcoming years.

Second, it has been (another) bad year for emerging markets. But again, this is selective underperformance (i.e. China) and the reason why I do not hold any Emerging Markets ETFs—which tend to overweight China. Instead, I focused on country-specific strategies, incl. India, China Tech, Japan (not an emerging market obv), GCC, Vietnam, and South America. While China Tech and Vietnam have not panned out yet, India, Japan, and South America have been outperforming regions this year. Going forward, I will probably liquidate my Vietnam exposure and shift this to either Indonesia or double down on China. But more on that in the upcoming weeks.

I hope you enjoyed this short update. If you have any questions regarding my general investment strategy, let me know and I might include some answers more regularly. In any case, we are just getting started as the most juicy part is still ahead of us: The predictions newsletter will obviously have its own financial market section. Stay tuned for that!

Peace,

SG